3 Pricing Lessons the Travel Industry can Learn from B2Bs

The global airline industry is in recovery mode. Some are further along than others. The number of international flights being booked for business purposes increased more than 400%, while domestic bookings increased by 18% in the same period, according to data from Flight Centre.

As planes begin to fill up, competition between airlines will become more intense. At the same time, people’s post-pandemic travel behavior has been significantly disrupted. Remote work has enabled many people to relocate closer to one’s family and support network. Moreover, working from home also shifted to more educational and business engagements online. All these make it more difficult for airlines to predict travel patterns, forecast demand for future travel, and optimize revenue.

As airlines look for every opportunity to drive demand and capture more bookings, there is a lot to be learned from the business-to-business (B2B) industry. B2Bs have traditionally operated successfully amidst high demand volatility under highly competitive markets. And airlines should embrace some of B2B’s demand forecasting and pricing best practices to capture the most market share.

Here are three lessons that airlines can take from the B2B industry to help optimize pricing and manage revenue.

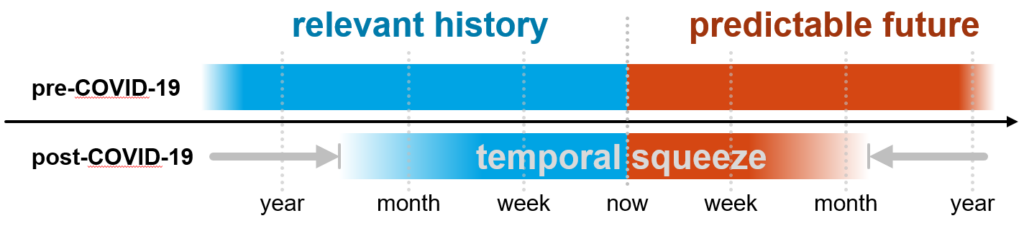

1. Shorter history, shorter forecast, more frequently

Due to the high predictability of people’s travel behaviors, airlines have traditionally leveraged long history (i.e., seasonality) over many years to help forecast travel demand far out into the future (up to a year out). This is what enabled consumers to book and pay for their flights up to a year in advance. However, the pandemic has significantly disrupted this, and long-historical bookings are no longer as predictive for far-out future travel. So, airlines can’t use their historical seasonality in the same manner as before. But it would be a grave mistake to say history is irrelevant.

B2B enterprises have always operated under demand uncertainties. The global supply chain has made the B2B market extremely competitive, because buyers can find equivalent products at a comparable price and switch vendors easily. Therefore, B2B companies must use a shorter relevant history (typically a few months or weeks) and forecast a shorter window (few weeks or months) into the future.

However, this reduced data requirement enables B2B to do these short forecasts quickly, more reliably, and more frequently. Consequently, B2B businesses can track the dynamic market condition more effectively. As more passengers are booking closer to departure due to the uncertainties created by the pandemic and geopolitical conflicts, this practice could help airlines capture more bookings and recover faster.

2. Greater variety of data from more diverse sources

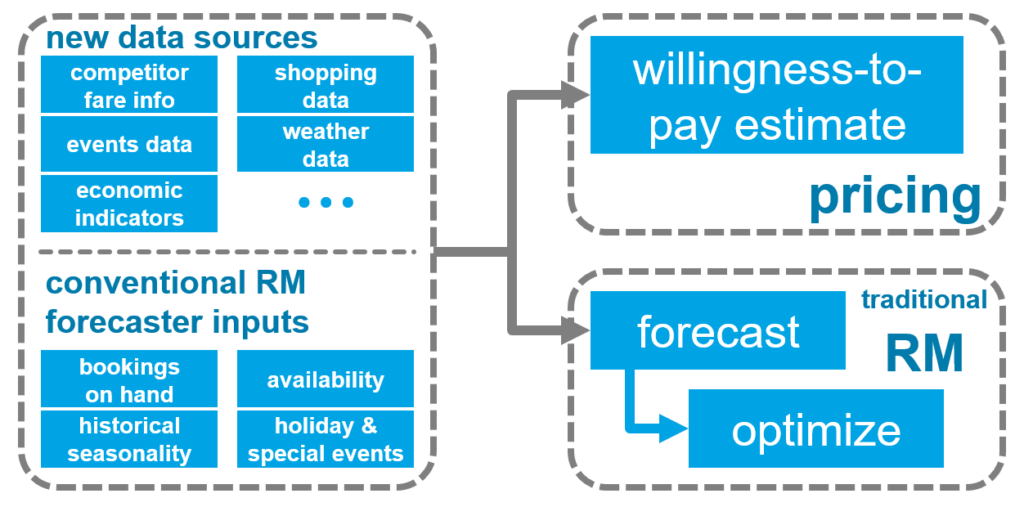

Conventional airline revenue management (RM) systems use four major inputs to help them forecast demand and optimize prices. These include:

- historical bookings (i.e., seasonality)

- current bookings onhand

- realtime availability

- holidays and special events

Since the onset of the pandemic, airlines can only use a shorter booking history to make near-term forecasts. This significantly reduces the data volume that airlines can use to forecast future travel demand, and therefore reduces the confidence of these forecasts. To improve the accuracy and confidence of demand forecasting, airlines can learn from B2B and retail businesses by incorporating more variety of data from different sources into their forecasting engine.

In both B2B and retail (where demand volatility is the norm), when businesses can’t use more of the same data (i.e., longer history), it’s natural for them to use more different kinds of data to help improve the confidence of their demand forecasting. It’s fairly common for B2B marketers to use 10 or 15 different data sources to help them forecast the demand for their products and services. And these may include everything from historical purchases, web searches, website clickstreams, competitor prices, to social media mentions, impressions, and more.

Some additional data sources that could potentially improve airline demand forecasting include flight search data, events data, weather, fuel price index, and even economic indicators. Our research found promising results when using both flight search data and events data to augment conventional booking forecasts. Using a test period during the pandemic, our research found flight search data could improve demand forecasting accuracy by up to 40% at an aggregate level for a small sample of 35 international markets.

3. Take into account of willingness-to-pay (WTP)

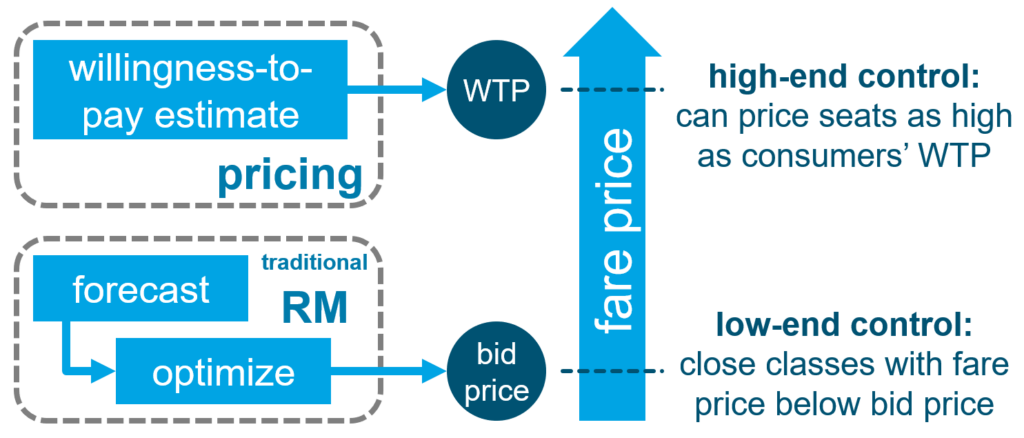

Most RM systems work by generating a bid price vector as the output of its optimization procedure. Since the bid prices represent the expected marginal opportunity costs of a seat under different availability conditions, airlines use it as an effective control mechanism to close fare classes that are priced below the bid price. This makes perfect sense economically, since selling below the bid price means the airline would incur a higher opportunity cost than the sales price.

This is a low-end control, and it’s most useful when the demand is high, and the airline is capacity-constrained. However, conventional RM systems don’t have a high-end control mechanism, and it doesn’t tell the airline how high they could or should price a seat. Coincidentally, COVID-19 has collapsed the demand for air travel, so that airlines are no longer capacity-constrained. The huge excess in capacity would drive the bid price down to zero. Clearly, telling the airline to not sell a seat below $0 isn’t useful, since the airlines already knew this.

When there is a demand collapse, a high-end control would seem more useful. This is accomplished by estimating the consumers’ willingness to pay (WTP) for a seat. Since most B2B transactions are negotiated based on business relationships and context, B2B pricing has always been predominantly determined by the buyers’ WTP. The state-of-the-art B2B pricing engines are combining transaction history with both product and customer attributes to predict the WTP price under different business scenarios.

Airlines could benefit tremendously by considering passengers’ WTP and factoring WTP into their control mechanism, especially during demand disruptions.

Conclusion

Airlines are more mature than many other industries in that they’ve been doing predictive and prescriptive analytics for a long time. As the pandemic recedes, it’s important to remember that flight demand will return even though it will be different. Airlines that can learn from B2B businesses that have operated successfully in current market conditions will be most equipped to handle these differences. Moreover, those that can quickly adopt the AI technologies and pricing practices from B2B will have more tools to inform their revenue management, and they will acquire long-term competitive advantages in the market.

DISCLAIMER: The content of this article was first published by Global Travel Media. Here is the latest revision and a current rendition of the raw manuscript submitted to the publisher. It differs slightly from the originally published version.