Building a Unique Moat – Part 3: The PROS Differentiation

Previously, we’ve examined some common strategies for developing a moat for your business. We’ve also analyzed 2 very important companies in the world of AI today and identified their highly specialized moat. This made me wonder, “Does PROS have any unique economic moat?” Since PROS has been in business operation since 1985 for 38 continuous years, it must have some moat.

BTW, in case you missed the previous posts in this mini-series, they are here:

- Building a Unique Moat – Part 1: Common Strategies

- Building a Unique Moat – Part 2: Not All Moats Are Created Equal

A Combination of Common Moats

It’s not hard to see that PROS leverages a combination of common strategies to create its moat. The PROS brand is definitely well recognized amongst airlines, and our proprietary AI is the best in class. We also have strong and strategic customer relationships, and we co-innovate with our customers while reinvesting heavily in R&D. When I was hired ~5 years ago, I was surprised to find that PROS reinvests ~30% of its revenue back into R&D, which is exceptionally high (~2x what I’ve seen in many Silicon Valley tech giants). Moreover, our heritage in airlines means there will also be a higher entry barrier from the more stringent security and compliance requirements set by regulatory bodies. Aside from these intangible assets, we also have a switching cost moat as our platform is not only mission critical, it’s deeply integrated into our customers’ operations.

Where B2B Pricing Meets Airline RM

PROS also has a very peculiar moat. When I was joining PROS, I did a fair amount of research into this company as I didn’t know anything about it. An unusual feature about PROS that stood out is the fact that it has 2 distinct business units in both Travel and B2B. Moreover, they almost operate like 2 separate companies with little overlap. Even the core algorithms underneath their respective product suites are very distinctive, let alone the sales, marketing, and customer support operations. I never quite figured out the reason why PROS is not 2 separate companies until the pandemic, when I was leading a team of scientists conducting research to improve our algorithms.

Evidently, having both the Travel and B2B side of our business offers a very unique differentiation. These 2 sides of the business complement each other so well that they have enabled the development of novel pricing models that are robust under disruptions using very creative approaches. Ultimately, the cross-pollination between Travel and B2B resulted in several new and innovative products.

The video below will provide an overview of the significant findings from our research studies. I’ve also had the privilege of inviting the scientists involved in the development of these new products to talk about the distinctive features of their creation.

Abstract: The nuances of the airline vs. B2B world have always called for different approaches to pricing. But as market volatility and complexity have grown dramatically (especially as we emerge from the pandemic), these two worlds are converging! So what can they learn from each other? Airline revenue managers are suddenly dealing with a shorter, more recent set of relevant histories to forecast demand. They can benefit from thinking like B2B pricing analyst and incorporate new data sources into the predictive pipeline. This will allow them to better estimate the passengers’ willingness-to-pay (WTP) in order to price robustly against huge demand shifts. On the flip side, Today’s B2B pricing analysts must deal with supply shortages and volatile shipping costs due to the disrupted supply chain. They, too, can benefit from thinking like their airline counterparts, who are specialists in pricing under a capacity-constrained market. This is due to the relatively inelastic supply of seats on a flight. As our teams of scientists help our customers address these new challenges, we’ve created the blueprints for many innovating solutions. These innovations are pointing to a rare and interesting phenomenon — technology convergence.

The Connection Between Airline RM and B2B Pricing

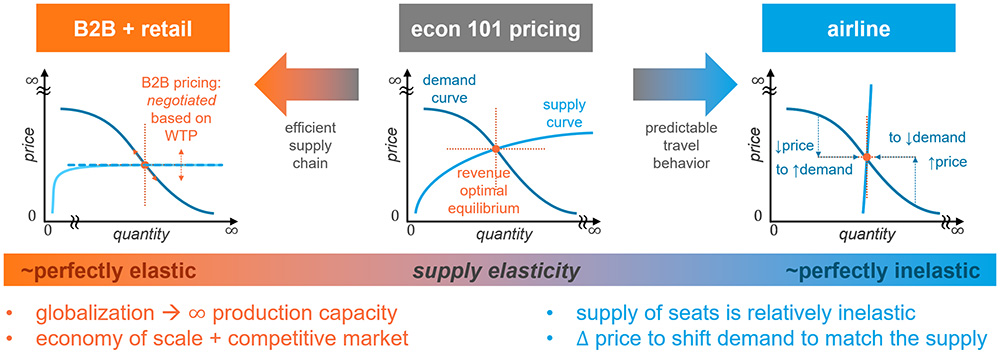

What I’ve learned through this exercise is that B2B pricing and airline RM are merely 2 extremes on the supply elasticity spectrum. In airlines, the supply of their products (i.e. the seat) is nearly perfectly inelastic (depicted by a nearly vertical supply curve). That means airlines can’t easily change the supply of their seats (i.e. capacity) to match the shifting demand. So instead, airlines change the prices of the seats to control demand. However, since passengers usually book a seat for travel in the future, airlines must forecast demand in order to set the proper prices to shift future demand back to equilibrium by aligning with the remaining available seats. This is the essence of RM.

For global B2B and retail, the supply of their product is almost perfectly elastic (depicted by a nearly flat supply curve). The flatness of the supply curve comes from the economy of scale of the global suppliers whose marginal cost of production is negligible in the near-infinite supply range. Moreover, this supply curve is stable due to the hyper-efficient supply chain as a result of globalization. Hence the supply curve can be treated as a fixed cost that stays constant as demand changes. This allows B2B and retailers to disregard the supply cost when pricing, so they can focus on modeling the demand elasticity. Finally, the main difference between B2B and retail is that B2B pricing is negotiated based on business context and relationships, so it can be priced off-equilibrium depending on the customers’ WTP. That is why most B2B pricing models are essentially WTP estimation algorithms.

Convergence and Complementarity Between Travel and B2B

Curiously, when the pandemic disrupted the conditions that drove these 2 sets of solutions apart (i.e. predictable travel behavior and efficient supply chain), we saw a rare convergence of these technologies. This has allowed our B2B pricing solution to leverage the expertise in RM from the airline side of our business, and vice versa, to develop robust pricing and RM algorithms using highly unconventional approaches.

This benefited both the Travel and B2B sides of our business by providing pricing solutions that will work under any supply elasticity characteristic. It expands our target addressable market by opening doors to industries (e.g. cargo, etc.) that were previously underserved by our past solutions. Moreover, this clear connection between the B2B and Travel side of our business has accelerated the effort to evolve the 2 apparently disparate product suites into a single unified PROS platform.

The Most Unique Moat: Having the Best of Both Worlds

From an economic science perspective, B2B pricing and airline RM are literally on opposite ends of the spectrum. The ability to meet the needs on both ends means we can also cover everything in between with the PROS platform. If you want to understand this more deeply, I’d strongly recommend taking a careful look at the video above, because it should be crystal clear why PROS is one company rather than two. Remarkably, this synergy goes beyond economics and extends to our technology and platform as well.

Technological Synergies Between Travel and B2B

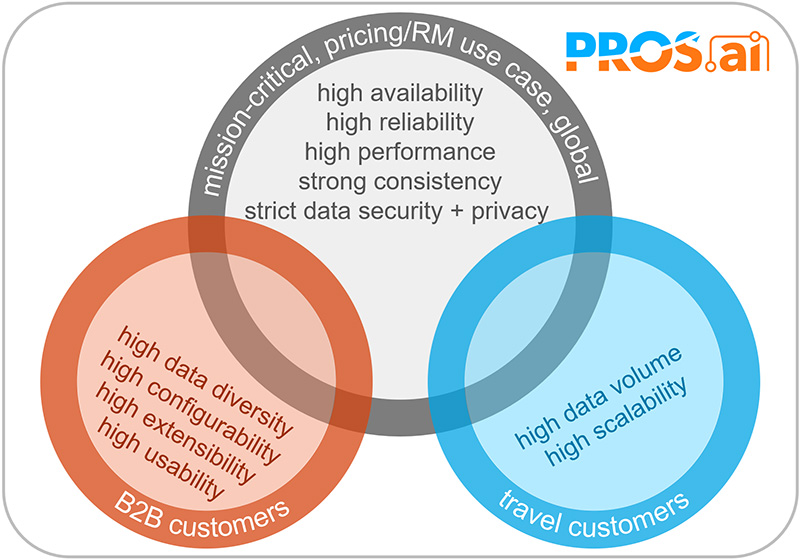

Because pricing and RM are both mission-critical, our platform must have high availability, high reliability, and high performance. In layman’s terms, it simply cannot fail and must work properly without performance degradation under nearly all circumstances. The standard approach to achieve these “-ilities” is by introducing redundancy. However, redundancy creates consistency challenges across the redundant systems. While many highly available and reliable systems can opt for the weaker eventual consistency model, our use case in pricing and RM precludes this and requires stronger consistency. Publicly presenting any inconsistent pricing data could be considered a discriminatory practice, and this can turn into a PR nightmare. However, strongly consistent systems require data synchronization across them, which requires immediate computing resources and makes it harder to achieve high performance.

As you can see, just trying to meet all the common requirements between our B2B and Travel customers is already a very tricky system engineering challenge (as suggested by Eric Brewer‘s CAP theorem). Moreover, because our customers are global, we must fulfill these requirements while adhering to the world’s strictest data security and privacy standards. Yet, the Travel and B2B side of PROS imposes new and unique business requirements that further exacerbate these challenges. Moreover, the inherently divergent needs between our Travel and B2B customers make satisfying both sides next to impossible.

For example, our Travel customers (i.e. primarily airlines, but also include hotels, car rentals, etc.) have much higher data volume and scalability requirements. Because airlines are B2C, their transaction rate (~3M/sec) is several orders of magnitude higher than that of a typical B2B business (~500/sec). Putting this in perspective, the transaction rate limit of VISA’s global network is only ~65K/sec with an average of 5K/sec. This instantaneous difference in transaction rate translates to an even more extreme difference in data volume when accumulated over the years. Therefore, by meeting these needs of our Travel customers, our platform will automatically meet the data volume and scalability needs of our B2B customers.

In contrast, our B2B customers, coming from 20+ different industries, have much higher configurability and extensibility needs compared to our Travel customers. The diverse business operations across industries create data heterogeneity. This complexity is further compounded by the considerably larger ecosystem of non-standardized systems of record, making the integration process more intricate. While a large airline may have hundreds of products and services, a global distributor could carry millions of products sold in equally diverse ways across the planet. Because B2B customers have unique workflows, specialized analytics, and track different KPIs, the collective complexity across our B2B customers is exponential. This demands an extremely flexible platform that can be configured and customized for each. In fact, our platform needs to be so flexible that it’s extensible, allowing each B2B customer to incorporate proprietary data and even algorithms to meet their unique business requirements. Furthermore, B2B customers also have a higher usability (user interface and user experience) requirement, because they are not bound by the legacy systems (e.g. reservation systems, global distribution systems, etc.) that still tie airline employees to terminals.

Now, by meeting the collective requirements of our B2B customers, we automatically future-proof our Travel customers’ impending data diversity, customization, and extensibility needs. For example, a hypothetical airline may want to ingest a variety of predictors from novel 3rd-party data sources to augment our forecasters’ standard input. With our Extensible AI capabilities, airlines can even augment our forecaster with proprietary algorithms. Moreover, our Travel customers also get a modern UI with a much better UX through our PROS platform.

Getting the Best of Both Worlds in Our AI/ML

In business, it’s often the case that you can’t have your cake and eat it. Some of the most difficult business decisions involve navigating difficult trade-offs. However, PROS boasts a robust track record of effectively addressing such apparent conflicting demands. We have achieved all the “-ilities” and met all the business requirements above. And for that, we were featured in “The Art of Scalability” by eBay’s CTO and PayPal’s VP of Engineering. This attests to our ability to strike the perfect balance that extracts the best of both worlds. In fact, our technological prowess often enabled us to accomplish more and get the best of multiple worlds. This distinctive PROS culture has permeated beyond our engineering teams into our AI development endeavors as well.

For example, it is well known among data scientists that highly flexible and powerful machine learning (ML) algorithms (e.g. deep neural networks, random forest, etc.) are essentially black boxes that are often not interpretable. Despite their superior predictive performance, many are reluctant to use these black-box algorithms in pricing due to the lack of interpretability. Interpretability is crucial to fostering trust in AI and driving the adoption of AI, because human users are unlikely to rely on systems they cannot comprehend, especially for high-stake decisions, such as pricing and RM.

So how can we get the power and performance of a deep neural network without sacrificing interpretability? We accomplished this by Explainable AI! So we achieved the best of both worlds again – the predictive power of neural network AND explainability (and therefore trust and adoption).

Conclusion

PROS has fortified its market position through a combination of common moats. With a renowned brand, proprietary AI, strategic customer relationships, and robust R&D investment, we stand as a formidable player. But PROS also has a very distinctive moat. The unique synergy between our Travel and B2B businesses makes our algorithms more resilient, our product more competitive, and our platform stronger. Having both the Travel and B2B sides of our business under one roof is our most powerful differentiation. No other company in the world possesses the breadth of customers on both sides, AND the depth of AI algorithms on both sides, AND the sophistication of technologies on both sides, AND the long history of working experience on both sides. This differentiation is untouchable, and so it’s also an impenetrable moat.

So, who says you can’t have your cake and eat it? With PROS, you can! We always get the best of both worlds, as evident in our AI algorithms, our technology platform, and our business; because we are pros (literally), and we have both sides. It’s part of the PROS culture, so it’s in our DNA. It’s our differentiation and our most unique moat.