COVID Task Force 6: From Prediction to Prescriptive Actions

Few months have passed since our last COVID Task Force (CTF) update. It’s hard to believe that it has already been a year since we initially assembled. Today, as more vaccines are being deployed and more people become vaccinated, the travel industry is gradually recovering. Although we have not observed any hockey stick curve signifying a travel surge, the pent-up interest to travel is definitely observable with a progressively increasing speed of recovery. And this is largely driven by the need to see families and friends rather than the desire for tourism. All things considered, it’s a good time for an update of our ongoing effort.

In our previous update, we made several predictions about future bookings (i.e. 3—6 months in the future) in many global regions. This foresight provided businesses with a powerful tool to prepare for the uncertain future. The question is, how can we translate this knowledge of the future (3—6 months out) into actions that optimize the business outcome for the airlines? This is where we need to go from predictive to prescriptive.

If you recall our first blog post when we assembled the COVID-19 Task Force (CTF), we wanted to help our customers address 3 major concerns:

- How to manage the immediate crisis: Short-term advice that would help customers manage their pricing needs as a result of the sudden shift in demand

- How can we forecast business recovery: On a longer time horizon, provide early signs of business recovery as the pandemic is subdued, so customers can prepare in advance and be ready to resume business

- How do we reset to the new normal: Once a business recovery signal is detected, provide another set of best practice recommendations to help customers execute a smooth transition back to the new normal

We’ve come a long way since! And today, we are ready to address the last of the major concerns of our customers.

Tuning Your Learning Rate

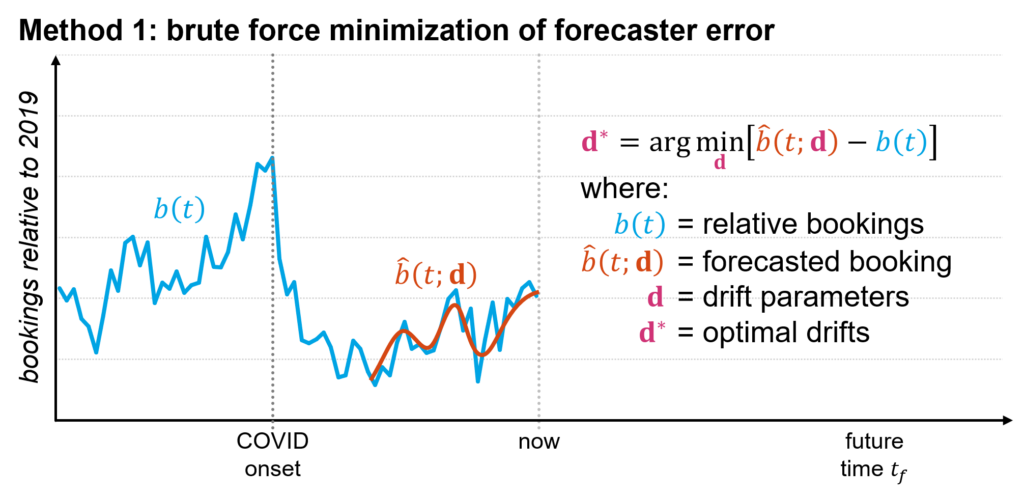

Although we cannot share the precise data we are sharing with our CTF airline participants, we will describe our approach, what we plan to do, and what we can expect. One important change we must implement to ensure your RM system is able to adapt quickly is the learning rate. For airlines RM, this learning rate is controlled by the drift parameters, which control the exponential time decay for the impact of historical data. So, a good set of drifts should allow the forecaster to react just fast enough to track the recent booking fluctuations.

We’ve implemented 2 methods to determine the optimal drift parameters. The first is a brute force minimization of the forecast error as a function of the drifts over the recent histories. This will ensure the forecaster’s ability to track the recent booking variations.

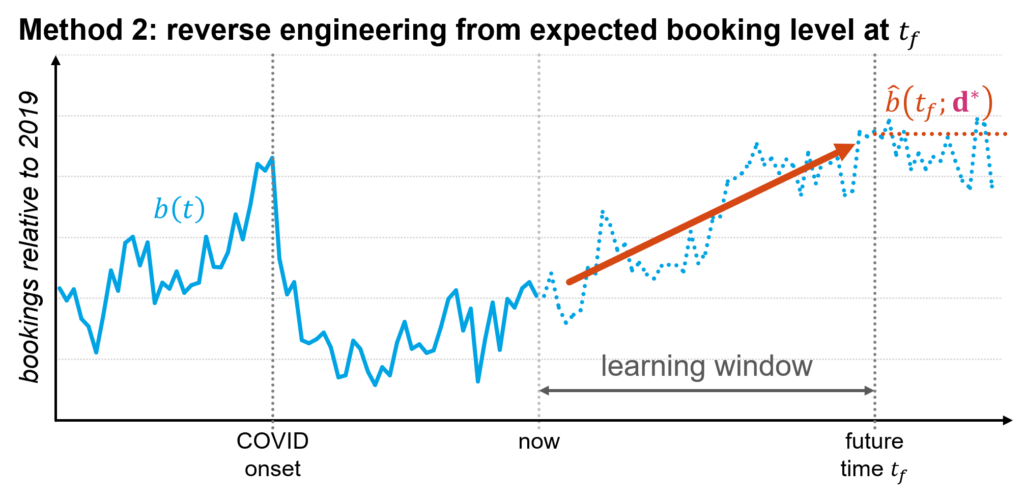

An alternative method is based on reverse engineering heuristics. If we have a predicted recovery pattern (even when it’s based on a hypothetical scenario), we would know the booking level, b(tf), at a specific future time, tf. Since we also know the current booking level, we can easily compute the difference over which the forecaster must reach in a learning window (which we’ll define as the time span between now and tf). With this information, the rest of the problem amounts to reverse engineering a value for the drift parameters that would allow the forecaster to adapt to the new booking level b(tf) within the learning window.

Data Censoring for Your Specific Markets

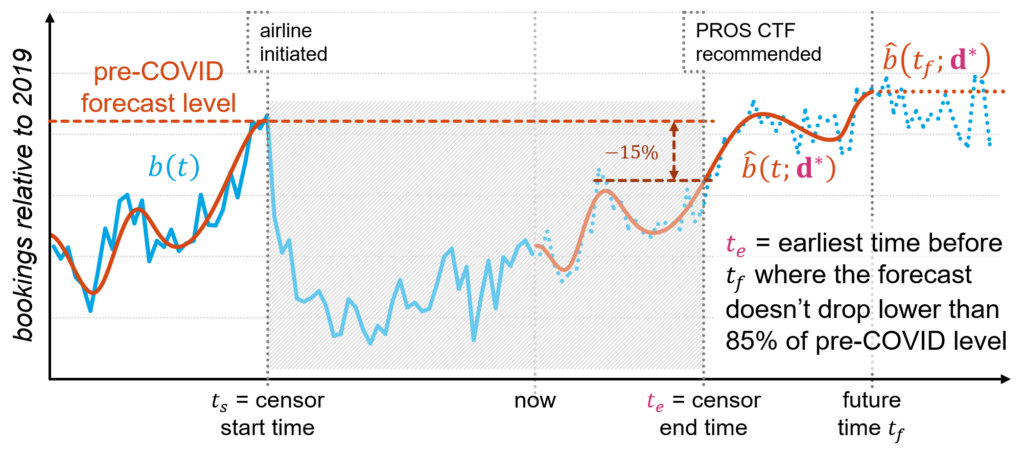

Since the drift parameters in the PROS RM system are global settings, they set the learning rate for our Bayesian forecaster. But how can this system be optimized for different markets with different recovery patterns? This can be accomplished by censoring, as we can apply data censorship at a very granular level, down to the specific origin and destination (O&D) pairs. The combination of the global change in drifts and the localized data censoring will allow our Bayesian forecaster to learn and adapt to the new normal.

After determining the optimal value of the drifts, our forecaster should react and track the changes in bookings more rapidly to adapt to the changing behaviors of today’s travelers. However, COVID has caused a precipitous drop in bookings across the board. So, if we did not censor this COVID-induced drop in bookings, our forecaster would quickly adapt to the lowered level of bookings. Although this might seem like exactly what we wanted right now, we must not be so shortsighted and only focus on the immediate present — all actions now will have future consequences.

By not censoring these booking outliers caused by COVID, our forecaster would treat these extraordinarily low bookings as real historical seasonality. That means next year’s prediction at the same time would come out much lower than expected. Consequently, a huge amount of manual influences would be required to re-adjust the demand or prices to the proper level.

Since the current bookings data is unrepresentative of the future, we must censor this data to prevent our forecaster from treating it as real historical seasonality. But this also makes the forecaster ignore the current bookings, so it won’t be able to adapt, track, and follow the precipitous drop in bookings during the pandemic. So, “to censor, or not to censor,” that is the question. And it seems like a double-edged sword that is going to cut either way.

However, there is a silver lining. We can find the delicate balance in this equation by censoring just the right amount. As bookings recover, we can censor the un-representative data during the pandemic until the recovery has reached a certain level. Since we can estimate the recovery rate of the booking data and the learning rate of our forecaster, we can determine the optimal recovery level to stop censoring for each O&D. And this level can again be reverse-engineered from the future time (tf) where the expected booking recovery will meet the expected drop of the forecaster.

The Perks of Joining the CTF

If you are still wondering what you will get as a participant of the CTF, here it is. As CTF participants, you do get a few extra perks in addition to the generic insights that we’ve been publishing as part of this blog series. First, you can provide inputs to augment the standard scenarios that are forecasted from IHME’s future projection. That means you can essentially tell us which future scenario you want to see, and we will simulate that future recovery pattern for you. You would just need to provide precisely what that future scenario is.

Participants also receive more granular and customer-specific predictions. Although we are only allowed to publish predictions that are aggregated to the regional level, participants can get more granular scenario predictions for all the countries covered by their network. These carrier-specific recovery predictions are based on the customer-specified scenarios. And they will serve as part of the input to the next stage of our study which will determine the drift parameters and all the censoring windows for an airline.

This is not a trivial feat, as a cookie-cutter approach won’t work. Because many airlines have already implemented their own censoring strategy. Some are still censoring a lot of markets, while others have already stopped most of their censoring, and yet, some never applied any large-scale censoring in the first place. The best part of joining the CTF is that our brilliant data scientists at PROS will take care of all the abovementioned coding, optimization, and reverse engineering.

This is how we will help you configure your PROS revenue management (RM) system for the expected new normal to come. Although the output product doesn’t look flashy, you get a few numbers for the updated drifts and a list of censoring recommendations for your O&Ds. The true benefit of being a part of the CTF is the ability to adapt to the new normal faster and recover from the pandemic sooner.

Conclusion

The CTF was initially thought to be a small project that would only last a few months. It has now turned into a company-wide effort that still has strong momentum a year later. And today, a year later, we are still standing behind our customers supporting them through this very challenging time.

We went from building predictive models that forecast the booking recovery to prescribing settings that re-optimize our customers’ RM systems. In other words, we are turning our model predictions into prescriptive actions with business impacts in the real world. Some of the CTF participants have already received the results of the science study with optimized drift settings and censoring windows. And, there are many more to go as we have a surprisingly large number of global airlines participating in the CTF.

Personally, I am very pleased with the level of interest, engagement, and participation from the airlines. It confirms a long-held belief of mine, and that is despite our competitive nature, in times of crisis, we can still set our differences aside and contribute to the common good. Whether it’s the airlines taking a leap of faith to contribute their extremely sensitive booking data, or the countless hours of research and coding from our PROS scientists, it feels good to know that we have contributed to the smoother recovery of the entire travel industry.

We are certain of our contribution because we are constantly evolving our booking-recovery forecaster. The latest innovation is incorporating country-level vaccination rates as a predictor in our model. Most importantly, the collective data from all of the CTF participants is enabling a more accurate estimate of the global passenger flow. This leads to a better booking recovery prediction that ultimately results in the more optimal drift and censoring recommendations.

Together we are greater than the sum of each of us alone. And together, we will all return stronger to compete again in the next big race.

If you’ve missed any of the earlier CTF updates, they are all accessible here:

- PROS Assemble! The COVID-19 Task Force

- COVID Task Force 1: Managing Your Business Under Crisis

- COVID Task Force 2: Revenue Management Under Lockdown

- COVID Task Force 3: What Are We Doing With Your Data

- COVID Task Force 4: Building A Crystal Ball for the Airlines

- COVID Task Force 5: How Airlines Will Return to Cruising Altitude