COVID Task Force 7: The Future of Revenue Management

In our previous COVID Task Force (CTF) update, we described our approach that turns our global booking recovery predictions into tangible actions for the airlines. These actions involve updating the drifts and applying data censorship in the airlines’ revenue management (RM) system. These prescriptive recommendations will tune their RM to adapt and function more optimally in the post-pandemic world, where demand is more volatile, more dynamic, and more uncertain.

Some airlines have already received these recommended drift and censoring settings. While there are still unfinished works to generate these custom recommendations for all CTF participants, we have addressed all 3 questions below that sparked the creation of the CTF:

- How can we manage the immediate crisis?

- How can we forecast business recovery?

- How do we reset to the new normal?

With that said, we will be winding down our CTF efforts, and this will be our last CTF update. Today, we will wrap up this mini-series by looking into some of the spin-off research initiatives from the CTF and discuss some future innovations in RM.

Is History Still Relevant?

Conventional RM consists of a forecasting phase that estimates the future demand followed by an optimization phase that maximizes the revenue. The RM forecaster has 4 major inputs:

- Bookings on hand

- Real-time availability (i.e. capacity made available for sale by the RM)

- Holidays and special events specification

- Historical bookings (i.e. seasonality)

Because most booking data has very strong seasonal components (i.e. one weekly and another yearly), historical bookings have always been a strong predictor of future bookings. Consequently, historical bookings over the past several years are an important input to the RM forecaster. The predictability of bookings data is a direct reflection of human behaviors. Contrary to popular beliefs, humans are highly predictable, especially in aggregate. In fact, we are so predictable that we are “predictably irrational,” as demonstrated by the world-renowned behavior economist—Dan Ariely.

However, COVID-19 has drastically changed people’s travel behavior. As a result, the 2020 booking data looks nothing like the previous years, and it’s probably not representative of the future bookings either. Does this mean history is irrelevant?

Absolutely not (history is NOT irrelevant)! Statistically speaking, historical data will always be crucial in any forecasting algorithm due to the inherent temporal correlation in time-series data. The difference now is how much of it we can use to forecast the future accurately.

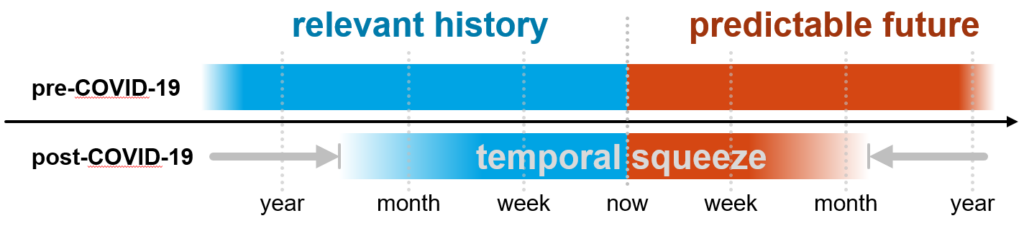

We can’t use years and years of historical data to forecast bookings far into the future, but we can and should still use the shorter relevant history to forecast the near future. I call this phenomenon “temporal squeeze,” as it reduces the relevant history we can use and shortens the future horizon we can predict. This is a natural consequence as the time series we are trying to forecast becomes less predictable.

Clearly, we can’t use historical data in the same way as before. But that doesn’t mean historical data is useless or history is irrelevant. It would be foolish to dismiss the utility of history altogether simply because we have a temporal squeeze.

Although history is still extremely valuable, the temporal squeeze does create a problem. Rather than relying on long histories over the past years, airlines must monitor the recent histories more carefully to understand the demand trajectory of the near future. It reduces the data volume that our forecaster can use, so it will inadvertently reduce our forecast’s confidence. How can we improve the confidence bound of our forecast?

Augmenting the Shorter History with Greater Data Diversity

Fortunately, this is not a new problem, and it’s one that retailers have dealt with for a long time. The demand pattern in the retail world is typically much more volatile and dynamic. This is largely due to the relative ease of access to large numbers of equivalent or replaceable products and services in the market. Consequently, the relevant history used in retail demand forecasting is usually very short, ranging from a few weeks to a few months.

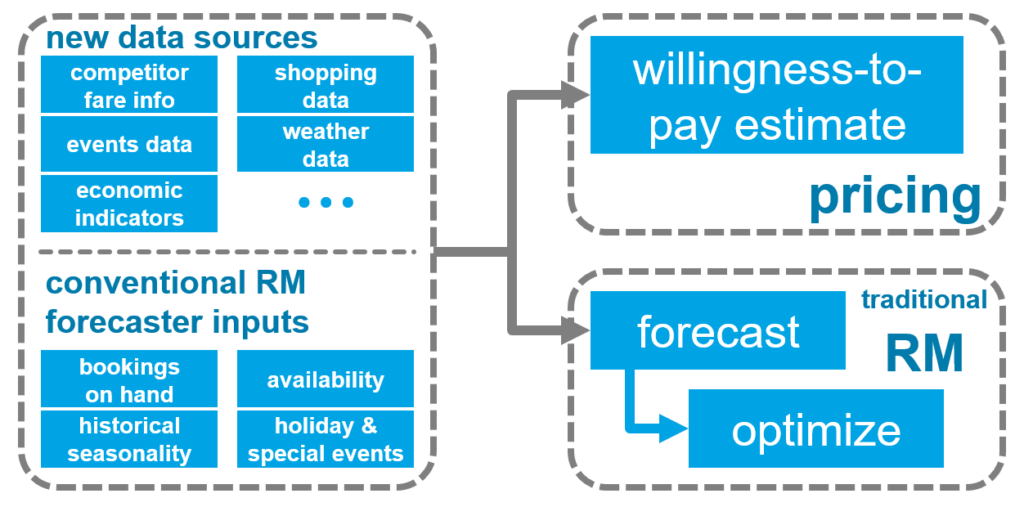

Retailers have been struggling with the temporal squeeze constantly and found an effective strategy to improve their demand forecast confidence. Since they can’t look further back into history, retailers have chosen to expand their data volume laterally by leveraging more variety of different data sources.

It’s not uncommon for retail marketers to combine dozens of data streams to help them forecast demand and interest for their product and service. These could include everything from website clickstreams, social media impressions and interactivities, consumers’ sentiment toward the brand, search engine redirects and search terms, data from loyal programs, engagement data from marketing campaigns, all the way to the consumers demographic, psychographic, and even technographic segments.

Therefore, the first thing that airlines must learn from retailers is to incorporate more variety of data sources as predictors of future bookings. This can significantly increase the data volume used by the forecaster and recover the lost confidence due to the temporal squeeze.

Disentanglement: the Separation of RM and Pricing

However, the airline industry does have a nuance that makes it slightly different from retail operations. Unlike retail, the supply of seats for a flight (i.e. the capacity) is relatively less elastic. Once a certain capacity is allocated to a specific origin and destination (O&D) by Network Planning, it can’t easily change to match the dynamic demands of the market.

This is why airlines do RM in the first place. Rather than changing the supply of seats (which is less feasible on short notice), airlines change the price of a seat to control the demand level. This allows them to shift the demand throughout the booking horizon to match the available capacities (i.e. the availability) for an O&D. And this is how airlines maximize the revenue from the pre-allocated capacity within a market.

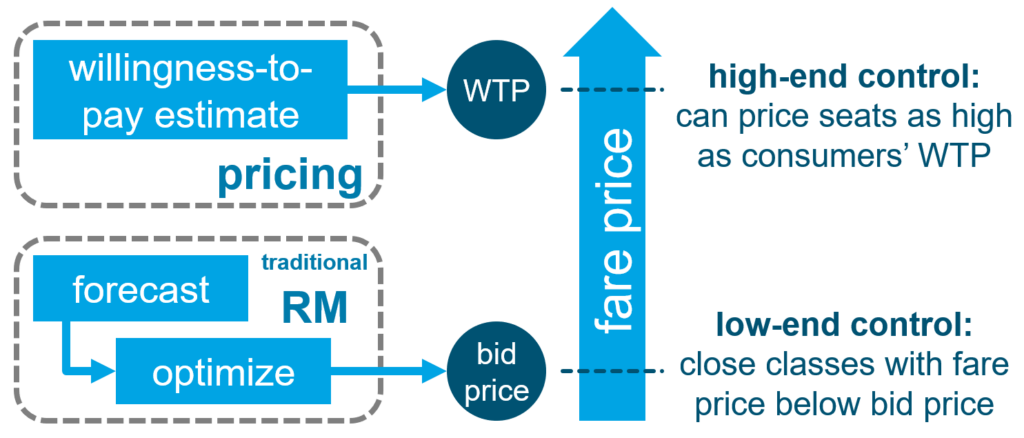

Traditional RM provides airlines with a low-end control mechanism, and it tells the airlines how low the sales price for a seat they can accept. This is accomplished in the optimization phase of RM, which outputs a bid price vector that represents the expected marginal opportunity costs of a seat under different availability conditions. This knowledge can serve as an effective control that prevents an airline from selling a seat below the bid price. Doing so (i.e. selling below the bid price) means the airline would be incurring a higher opportunity cost than the sales price, and the airline would’ve made more later by not selling that seat now. Therefore, the control mechanism will close all fare classes that are priced below the bid price.

This low-end control is most useful when the demand is high and the airline is capacity-constrained. When the future demand is high, the optimization phase of RM will increase the bid price and therefore allowing the airline to gain more revenue.

Conventional RM systems don’t have a high-end control mechanism, and it doesn’t tell the airline how high they can or should price a seat. However, COVID-19 has collapsed the demand for air travel, so that airlines are no longer capacity-constrained. Unless the airline reduces its capacity (physical or virtual) by canceling flights or blocking middle seats, the low-end control isn’t helpful. Hypothetically, the huge excess in capacity could drive the bid price down to zero. Clearly, telling the airline to not sell a seat below $0 isn’t useful, since the airlines already knew this.

When there is a demand collapse, a high-end control would seem more useful. This is accomplished by estimating the consumers’ willingness-to-pay (WTP) for a seat. Although we have developed WTP in our RM system to combat the buy-down behavior of consumers due to the less restrictive fare structures introduced by low-cost carriers, this function would be extremely useful in the post-pandemic world. Although WTP can change, it’s more sensitive to consumers’ environment and context that are readily seen and felt by the consumers. It is less sensitive to the global market variables that are less visible to the consumers. Therefore implementing a high-end control using knowledge of consumers’ WTP will provide greater stability in the price for a seat. This will, in turn, reduce the volatility of the revenue stream for airlines.

The appeal of having a dual control (i.e. having both high- and low-end) is obvious, as it provides more robustness against huge demand shifts. So the second thing that airlines must learn from the retailers is to augment their traditional RM with a high-end control mechanism based on WTP estimation. This is called disentanglement, as it separates and disentangles the low-end control (RM) from the high-end control (pricing through WTP estimation).

Researching and Innovating the Next-Gen RM at PROS

Coincidentally, the pricing practice in many other industries (including retails) with more elastic supply involves estimating WTP, and this can also benefit from the use of more variety of data sources. As we are not a traditional RM provider, we already have WTP incorporated into our RM system. Moreover, we have optimized the tradeoff between the traditional bid price and WTP, and we can now provide airlines with a single optimal policy that considers both low- and high-end controls.

As Winston Churchill once said, “never let a good crisis go to waste,” our CTF effort has spun off several research initiatives to further our innovations. Here are a few investigations that focus on incorporating new data sources into our predictive pipeline to improve RM either through demand forecasting or WTP estimation.

- Using competitor fare information in WTP estimation: This research was recently published in March 2021 in the Journal of Revenue and Pricing Management.

- Using consumer shopping data to augment booking forecast: This research was also presented recently at AGIFORS’ RM study group.

- Using event data to predict demand impact early.

Although these studies are still in their early stages, we are already seeing promising preliminary results. Yet, this is just the beginning. These are just the first batch of data sources we have been toying with, and there are likely many more to come. Once we abstract the predictive pipeline for incorporating new data sources, we could generalize this process to other data sources, such as weather data, economic indicators, etc.

The pricing practice in many industries has evolved significantly over the past decades. Some have specialized to handle the nuances in specific industries, such as the relative inelasticity of the supply for seats on a flight. This specialization gave rise to the RM practice in the airline industry, which looks nothing like the pricing practice as we know it today.

Yet, the airline RM discipline will continue to evolve. And similarly, the future of RM will no longer be just the conventional RM taught in school. It will likely be a combination of RM and pricing (via WTP estimation). Both of these control mechanisms will leverage many third-party data sources beyond what has been used traditionally. And we are here to help our airline partners to make the leap from traditional RM to future RM.

Conclusion

COVID-19 has severely disrupted the global demand pattern for travel. This greatly compromised airlines’ ability to forecast future demand and therefore optimize revenue. Although airlines can’t use historical data the same way, history is still very important in demand forecasting. However, existing airline RM operations can be improved to achieve greater robustness and stability during unforeseen disruptions.

As it turns out, airline revenue managers can learn a lot from retail’s pricing practice. There are 2 important lessons for the airlines:

- Airlines must learn to leverage more variety of data sources in their RM operation. This will augment the shorter relevant history available for demand forecasting and improve WTP estimation.

- Airlines can benefit from disentangling RM from pricing and implement an additional high-end control as what’s been done in retail pricing (via WTP estimation).

Traditional RM can certainly be improved, but “RM isn’t canceled,” it will just be different. Airlines that can learn the proper lessons from their retail counterparts will regain stability in their RM operation sooner and recover from the pandemic faster. And we are always here to help make the transition smooth as we have helped our airline partners through the pandemic.

As we complete the promised deliverables to our airline CTF participants, we are also moving onto other interesting research agendas (including the abovementioned areas). I can’t wait to tell you the promising results we are seeing so far, but those will be shared through a different mini-series. So, for the time being, here is a complete list of all the blog posts in the CTF mini-series:

- PROS Assemble! The COVID-19 Task Force

- COVID Task Force 1: Managing Your Business Under Crisis

- COVID Task Force 2: Revenue Management Under Lockdown

- COVID Task Force 3: What Are We Doing With Your Data

- COVID Task Force 4: Building A Crystal Ball for the Airlines

- COVID Task Force 5: How Airlines Will Return to Cruising Altitude

- COVID Task Force 6: From Prediction to Prescriptive Actions